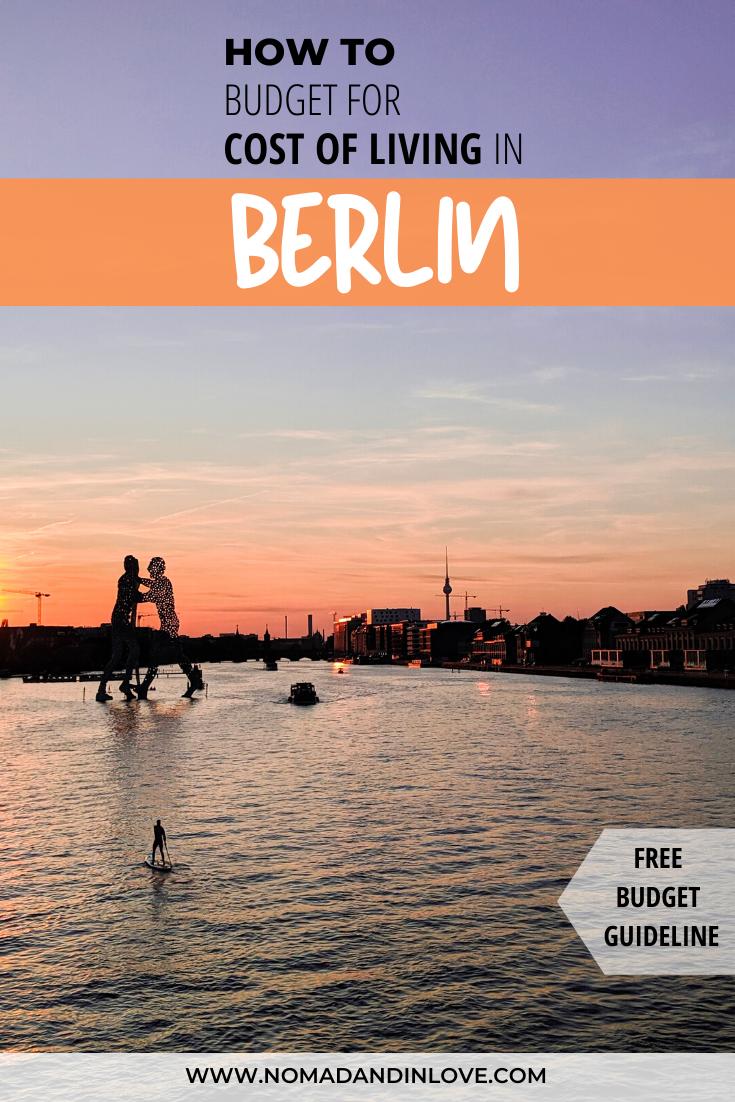

Thinking of moving to Germany? Expats share a detailed breakdown of the cost of living in Berlin and what monthly expenses to budget for in 2025.

If you’re planning to move to Germany, you may be wondering how much it costs to live in a city like Berlin. As a couple who has relocated, we’ll help demystify whether Berlin is expensive compared to the city you live in.

Perhaps you’re thinking of taking up a new job, relocating your business, retiring abroad or maybe you’re planning to further your studies. Whatever your reasons may be, this guide covers every expense you’ll need to budget for when living in Berlin.

This comprehensive guide includes what you can expect to pay for rent, groceries, healthcare, transport, gym, entertainment and more. We’ve also included a list of the most cost-effective companies we use, to help you easily settle into your new life abroad.

Why Move to Berlin?

Moving to Germany and living in a cosmopolitan city like Berlin is an exciting adventure. With millions of residents from diverse backgrounds, Berlin offers vibrant urban energy while being surrounded by lakes, forests, and nature reserves. Striking the perfect balance between city life and nature retreats.

Don’t get me wrong, the winters in Berlin are brutal! On dark, gray days, you’ll often question why on earth you decided to move here. But come summer, when the days are long and the weather is perfect, all those doubts will melt away, and you’ll be reminded why Berlin is worth it.

Berlin’s location is another major perk. It’s well-connected, making it easy to catch a flight to destinations across Europe and beyond. And as a consumer, you have plenty of options, with the latest technology and worldwide trends at your fingertips.

Best of all, Berlin offers all of this at a fraction of the cost compared to other capitals. Not only is it the most affordable major city in Germany, but it’s also one of the cheapest capital cities in Western Europe, proving that you don’t need to break the bank to live in a world-class city.

Whether you prefer a luxurious lifestyle or are careful with your spending, Berlin has something to suit every budget. In this guide, we’ll walk you through all the options we discovered while exploring the cost of living in Berlin.

Related Guide: If you’re planning to move to Berlin, check out our 21 Pros and Cons of Living in Berlin to help you mentally prepare for your relocation.

Biggest Costs to Consider when Relocating to Germany

Moving to Germany comes with several upfront costs, and renting an apartment is often the biggest expense (especially in Berlin). Beyond the monthly rent, you’ll need to account for the rental deposit and other one-time costs, which can quickly add up.

Relocation expenses, furnishing your apartment, and purchasing essential appliances can also take a significant chunk out of your budget. To help you plan better, here’s an overview of the biggest costs to expect when settling into your new home in Germany.

Relocation Costs

Relocating to a new country involves more than just packing your belongings. It can be one of the most significant expenses to consider when moving to Germany.

If you’re bringing furniture, appliances, or a household’s worth of belongings, you might need to use international relocation services to ship your items. These services often involve renting a shipping container, with costs ranging from a few thousand to several thousand euros, depending on the distance and volume of your shipment.

Additional fees for customs, insurance, and handling can quickly add up, making relocation services a substantial part of your moving budget.

But not everyone opts for such an extensive move. We took a minimalist approach to our relocation and decided to move with just six suitcases. Here’s how we did it:

- We booked a flight with Qatar Airways, which includes four checked bags in their standard baggage allowance.

- To cover the remaining luggage, we purchased two additional checked bags at 190.48€ per bag.

- This was our entire relocation, streamlined, efficient, and cost-effective!

If you’re able to downsize and prioritize essentials, this approach can save you a significant amount of money and make the transition to your new home much simpler.

Rental Deposit

You can expect rent to be about a third of your monthly salary in Berlin. But that’s not the only cost you’ll need to factor in.

Most landlords also require a rental deposit (Kaution) that ranges from 2 to 3 times the monthly rent. This is a significant upfront expense that you’ll need to pay before even moving in.

For our apartment, we had to make an upfront payment of 4,155€ for the rental deposit. It’s a substantial cost to consider, as it ties up a large amount of cash that will be held by the landlord until the end of your lease.

The deposit is typically refunded if the apartment is returned in good condition. But it’s crucial to carefully document the property’s condition when moving in to prevent any disputes later on.

Related Guide: Don’t miss our essential checklist: 10 Things You Must Do When Moving Apartments in Germany. It’s packed with tips to help you navigate your move and protect your rental deposit.

Furniture and Appliances

When moving into an apartment, one of the largest additional costs is furnishing the space and purchasing essential appliances.

We spent over 10,000€ furnishing our apartment in Berlin, which included everything from basic furniture to high-quality appliances. We bought most of our furniture from Ikea and Home24, which provided a great mix of affordable and stylish options for our home.

Just bear in mind that most furniture arrives flat-packed in boxes, so you’ll need to assemble it yourself. And if you’re not used to manual labor like us, be prepared for lower back pain and overdeveloped forearms from cranking a screwdriver a million times.

For appliances, we relied on stores like Saturn and Amazon, where we found good deals on everything from refrigerators and washing machines to smaller items like coffee machines and microwaves. The cost of appliances can add up quickly, but it’s essential to have everything in place to make your new apartment feel like home.

Whether you’re furnishing a one-bedroom apartment or a larger space, the costs can vary depending on your style, preferences, and the items you choose. But as we’ve found, investing in quality furniture and appliances upfront can make a big difference in your comfort and quality of life in your new home.

💡 Useful Tip: Consider extending the warranty on large appliances like dishwashers, washing machines, and refrigerators. They often break down shortly after the standard 2-year period, and repair costs usually exceed the price of an extended warranty.

Housing

Berlin’s rental market has changed dramatically over the past decade. While rents are still lower than in cities like London or Paris, they’ve surged in recent years, prompting the government to introduce measures like rent caps (Mietpreisbremse) and the short-lived rent freeze (Mietendeckel).

In theory, this should help keep housing affordable, a welcome relief for Berlin’s cost of living. But in reality, some landlords still find ways around rent control laws, charging inflated prices to unsuspecting tenants.

So, what can you expect to pay for housing in Berlin? Let’s break it down.

What is the Average Cost to Rent in Berlin?

The average rent in Berlin ranges from 7€ to 16€ per square meter (around 0.74€ to 1.49€ per square foot) for an unfurnished apartment.

This depends on several factors, including the apartment’s size, location, condition, and age. Newly built or modernized apartments tend to cost more, often exceeding the average significantly since rent control laws may not apply to them.

Prices also vary by neighborhood, with sought-after areas like Mitte and Friedrichshain reaching 13€ per square meter, while outer districts like Spandau and Marzahn are closer to 8€ per square meter.

Here’s a breakdown of average rental prices in some popular Berlin neighborhoods:

| Neighborhood | Price per m² (€) | Price per ft² (€) |

|---|---|---|

| Mitte | 13€ – 16€ | 1.21€ – 1.49€ |

| Prenzlauer Berg | 12€ – 14€ | 1.11€ – 1.30€ |

| Kreuzberg | 11€ – 14€ | 1.02€ – 1.30€ |

| Friedrichshain | 10€ – 13€ | 0.93€ – 1.21€ |

| Neukölln | 9€ – 12€ | 0.84€ – 1.11€ |

| Charlottenburg | 11€ – 15€ | 1.02€ – 1.39€ |

| Tempelhof | 9€ – 11€ | 0.84€ – 1.02€ |

| Spandau | 7€ – 9€ | 0.65€ – 0.84€ |

Rent prices are often listed as Kaltmiete (cold rent), meaning they exclude Nebenkosten (utilities and building maintenance fees), which can add an extra 2.50€ – 3€ per m² to your monthly costs.

🏡 Related Guide: Not sure where to live? Explore Berlin’s best neighborhoods in our Berlin Neighborhoods and Districts guide.

Our Experience Renting in Berlin

When we first arrived in Berlin, we found a fully furnished 65m² (700 ft²) apartment in a central location via Immobilienscout24. The rent was 1,180€ per month, Warmmiete, including all utilities (water, heating, electricity, and TV tax).

At first, we thought it was a fair price for a one-bedroom apartment. But after checking our rent on an online rent calculator, we quickly realized we were overpaying. Long story short, we managed to get a rent reduction of 317.64€ per month.

🏡 Related Guide: Want to know how we did it? Check out our Conny Review to find out how we got over 5,000€ refunded and learn how you can also challenge high rent and save money too.

We’ve since moved into a modern 100m² (1,076 ft²) two-bedroom new-build apartment (Neubau) in a quiet, leafy suburb within Berlin’s A zone (inside the ring). Our rent is 1,385€ per month (13.85€ per m²) Kalt, excluding utilities and building maintenance fees (Nebenkosten).

How Much Should You Budget for Rent in Berlin?

The cost of rent in Berlin can vary significantly from the average rent in the city. Typically, listings on real estate platforms like Immowelt.de are priced way above the neighborhood average. But just because a rent is advertised at a higher price doesn’t mean you should overpay.

Luckily, you can refer to the Berlin Rent Index (Berliner Mietspiegel) to check the maximum allowable rent for apartments regulated by Mietpreisbremse (rent control law). By simply entering the address, year of construction, and apartment size, you can determine whether the price you’re paying is fair.

As a general guideline, here’s how much you should budget for rent in Berlin:

- Renting a room: 350€ – 750€ per person

- Sharing an apartment: 500€ – 950€ per person

- Renting alone (1-bedroom apartment): 850€ – 1,500€+

Finding a place to rent in Berlin is notoriously challenging. But don’t stress, we’ve got you covered! Check out our How to Rent an Apartment in Berlin guide for tips on navigating the rental market.

Electricity

Electricity is a significant part of your cost of living in Berlin. On average, electricity costs can vary based on the size of your apartment, your usage, and your electricity provider. For instance, we pay approximately 75€ per month for electricity in our 100 square meter apartment.

Understanding how to choose the right electricity provider can help you save money in the long run. Find out how in our detailed Electricity Providers in Germany guide.

🔥 Bonus Tip: Want to save money and go green like us? Switch to Ostrom, an eco-friendly electricity provider, and join us in supporting renewable energy. Sign up using our referral code (NOMADXLOVE), and get up to 100€ bonus. It’s a win for your wallet and the planet!

Nebenkosten – Utilities & Building Maintenance Fees

Nebenkosten is a German term that translates to ‘additional costs’ or ‘ancillary costs’ in English. It typically refers to expenses that are paid in addition to the base rent (Kaltmiete) in rental agreements.

Nebenkosten cover various shared or usage-related costs associated with a rental property, including cold water (Kaltwasser), hot water and heating (Heizkosten), wastewater disposal (Abwasser), building maintenance, garbage disposal, property taxes, and sometimes shared amenities like cleaning of communal areas or elevator maintenance.

We pay 435€ per month for Nebenkosten, which covers all these essentials.

Tenants’ Association (Mieterverein)

Joining a Tenants’ Association (Mieterverein) can help you pay less rent. They have lawyers, assessors, energy consultants, and other staff working for them to support you in any disputes with your landlord.

For example, becoming a member of the Berliner Mieterverein only costs 11€ per month and has a minimum membership period of 24 months. But once you’re a member, you can ask their legal experts to check your lease and find out if you’re paying too much rent. And if you are, they’ll step in your shoes and get your landlord to reduce your rent.

Just bear in mind that there may be a waiting period before you can access legal services. So it’s best to sign up before signing a lease.

💡 Useful Tip: A Mieterverein can also help recover your rental deposit after moving out, the number one issue tenants face in Berlin after leaving their apartment. Having legal support can save you a lot of time, stress, and money.

Food and Grocery Prices

If you’re a foodie like us, then you’ll be happy to hear that food and groceries in Berlin are amongst the cheapest in Europe. Mid-priced supermarkets such as Rewe, Edeka and Kaufland usually have the best deals for everything you’d need under the sun.

But there are what seems to be an infinite number of supermarkets to suit every budget and palate. These include discount supermarkets such as:

- Netto

- Penny

- Lidl

- ALDI

And if you prefer ethically sourced organic food, you can find them at premium food stores such as:

- Alnatura

- Bio Company

- Denns BioMarkt

There are also countless independent grocers across the city, specializing in Asian, Turkish, Greek, and many other cuisines. And don’t miss out on the weekly farmers’ markets in select neighborhoods, where you can buy fresh, locally sourced produce straight from the farm to your kitchen!

💡 Useful Tip: Amazon Fresh also offers great deals on groceries, including a wide range of organic food products. With just a few clicks, you can enjoy the convenience of having fresh food delivered straight to your doorstep.

In order to keep our monthly costs low, we opt to cook most of our meals at home. Not only is dining in cheaper than eating out, it’s also healthier as you control what goes into your food.

Our monthly food and grocery costs rarely exceed 600€ per month (i.e. maximum 300€ per person). And that also includes cleaning detergents, coffee beans, wine, and everything one would usually buy at a supermarket.

For a better idea of grocery prices in Berlin, check out the latest weekly supermarket brochures (Prospekte) featuring discounts, special offers, and promotions on kaufDA.

🔥 Bonus Tip: You can earn PAYBACK points while shopping at select supermarkets, and redeem them for cash in-store. Sign up for your Free PAYBACK Loyalty Card and get 200 points (worth 2€) to get you started.

Health Insurance

Navigating health insurance in a country you know very little about can feel overwhelming. That’s why knowing which is the best health insurance provider in Germany is key to avoid the hassle of sifting through pages and pages of policy documents.

Luckily, we’ve experienced both expat and public health insurance firsthand. So we’ll be happy to spill the beans on what you can expect to pay, whether you choose public, expat or even private coverage.

Public Health Insurance

The gold standard of health insurance in Germany is Techniker Krankenkasse (TK). They’re the largest public health insurer in the country, but it will set you back up to 17.05% of your gross monthly income.

Fortunately, contributions are capped based on the maximum income threshold for statutory health insurance (known here as Beitragsbemessungsgrenze). And if you’re employed, your employer typically covers up to half of your monthly premium.

When we first arrived in Germany, we opted for expat health insurance because we didn’t qualify for TK. Turns out being freelancers at the time didn’t quite meet their requirements. But we’ve since switched to TK now that we meet their criteria for self-employed individuals.

As entrepreneurs, our TK health insurance contributions are determined by our earnings from the previous calendar year. Similarly, your contributions will also depend on your income which is assessed when you apply for TK.

💡 Useful Tip: Keen to get public health insurance in Germany but not so keen on signing policy documents or speaking to customer service in German? Don’t worry! Get public medical coverage with TK, AOK, BARMER, or DAK through Feather Insurance. Not only does Feather Insurance offer free advice on which health insurance suits you best, but you’ll also get all policy documents and customer support in English.

Health Insurance for Expats

For the first 5 years after arriving in Germany, we were covered by Mawista’s Expatcare for 69€ per month. It was the cheapest basic health insurance for expats we could find, though it honestly felt more like travel insurance. In Germany, they call it ‘incoming insurance’.

Mawista offers a variety of plans that cover a wide range of insurance benefits. But unlike TK, you’ll need to pay for your medical treatment upfront and then submit the invoice for reimbursement.

Expat health insurance may not be as comprehensive as TK, but it covers all the essentials. It’s also a great option if you’re looking for flexible, affordable, short-term health care while keeping your cost of living in Berlin low.

If you’re looking for more extensive coverage and can’t join public insurance, you might want to consider leveling up to Private Health Insurance.

🔥 Bonus Tip: Expat Health Insurance is one of the cheapest medical insurance you can get as a new expat moving to Germany. And the best part is that it’s accepted for first time visa or residence permit applications. Get a quote for Expat Health Insurance with Feather Insurance to find out more.

Health Insurance Calculator

Use this Health Insurance Calculator to compare the costs of public, private, and expat health insurance plans in Germany. It provides a clear breakdown of what you can expect to pay per month based on your personal circumstances.

If you need assistance navigating your options or understanding the results, you can reach out to an insurance expert for personalized guidance. They’ll help you find the plan that best fits your needs and budget.

Public Transport in Berlin

Navigating Berlin is incredibly simple thanks to its efficient and well-connected public transport network. So whether you’re hopping on a tram, the U-Bahn (subway), S-Bahn (overground train), bus, or even a ferry, getting around the city is a hassle-free experience.

Berlin’s public transport system isn’t just convenient, it’s also budget-friendly, helping to keep the cost of living lower compared to many other major European cities.

The public transport services in Berlin are managed by the Berliner Verkehrsbetriebe (BVG), or Berlin Transport Company. You’ll spot their bright yellow signs the minute you arrive in the city.

BVG offers various commuter fare options, including single-trip, daily, weekly, and monthly tickets, with prices ranging from 2.60€ for a short trip to 106.50€ for a monthly pass.

As we enjoy the occasional day trip outside the city, we take advantage of the Deutschland Ticket. This monthly subscription provides unlimited access to public transport across Germany. And for just 58€ per month, it’s also a great budget option for exploring the entire country.

💡 Useful Tip: Make sure you download the Berlin public transport map to have it handy for offline use. It’s super useful for planning your routes, navigating the city’s extensive public transport network, and making sure you don’t get lost if you’re without internet access.

Save Me For Later

Getting Around Berlin: Transport Options

While public transport is the most popular way to get around Berlin, it’s not the only option. If rubbing shoulders with the masses isn’t your thing, there are plenty of other ways to get where you need to go.

You can commute on two wheels, take advantage of car-sharing services, or opt for the convenience of taxis and ride-hailing apps like Uber. We’ve tried all of these options ourselves, so we’ll be happy to share what you need to know to get around effortlessly.

Getting Around By Bike or Scooter

When we first arrived in Berlin, we switched to cycling to get around the city. Not only is it a great way to reduce emissions, but it also helps you get exercise and stay in shape.

We used to use Swapfiets and really loved the freedom of getting around Berlin by bicycle! With Swapfiets, you get the benefit of owning your own bike for as little as 14.90€ a month! Check out our Swapfiets review to find out more about this bike rental service.

Besides Swapfiets, you can also get around using other bike sharing options or even electric scooters, which you can find virtually along any street in Berlin.

If you prefer owning a bike, places like Decathlon offer affordable options. Just beware that Berlin is also the bike theft capital of Germany, so invest in a good lock (or two)!

Getting Around By Moped

Last spring, we decided to switch to a Dance moped! It’s electric, environmentally friendly, fun, and honestly, the fastest way to get around the city.

We pay 63.99€ per month including extra protection. Meaning we pay 0€ if it’s stolen, and all repairs, including accident or vandalism damage, are fully covered.

One of the best things about it is that you never have to worry about parking. You can park it virtually anywhere, making it super convenient for city life.

A moped is also your lifeline during BVG strikes or unexpected public transport disruptions. While others may find themselves stranded, you’ll be zipping around the city without a care in the world.

On days when the weather doesn’t allow us to take the moped, we use public transport as our backup option, ensuring we’re never stuck without a way to get around.

🔥 Bonus Tip: Sign up for an electric bike online and ride from just 44.50€ per month! Plus, get 50% OFF a moped for the first 3 months with this Dance referral link.

Car Sharing in Berlin

If you prefer to drive or need a car once in a while, you have access to several car-sharing services in Berlin, including:

- ShareNow – get 5€ credit

- SixtShare – get 5€ credit

- FreeNow – get 10€ credit

- Miles – get 10€ credit with code: g5Dt22La1p

Each car-sharing platform has its own perks, with pricing based on kilometers, time, or both. So it’s easy to find an option that suits your budget and the type of car you need. We personally use more than one platform to make the most of what each service offers.

Related Guide: Moving to Germany and want to know how to convert a foreign driver’s license to a German driving license? Find out how in our step-by-step Driver’s License in Germany Conversion guide.

Taxis and Ride-Hailing Apps

If you prefer the convenience of commuting door to door or you just want to get home after a night out, Uber or Taxi is the way to go. Getting around Berlin by taxi is convenient, but it does come at a premium.

A minimum fare typically applies, varying by location within the city. There’s also a base fare, along with per-minute and per-kilometer charges, which can add up quickly.

The cool part is that you can estimate exactly how much it’s going to cost before requesting a cab. So make sure you’ve got both the Uber and Bolt app installed so you can compare fares between both apps.

🔥 Bonus Tip: Looking for another way to book a ride? Try FreeNow, a popular taxi and ride-hailing app in Berlin. If you’re new to FreeNow, download the app and use the code JOINFREENOW to get 10€ off your first ride!

Insurance

Wherever you live in the world, insurance is essential for financial security and peace of mind. It offers protection against unforeseen events without straining your budget. The good news is that insurance premiums in Germany are among the cheapest in Europe, making it easier to get comprehensive coverage without breaking the bank.

This affordability allows you to safeguard your belongings, health, and liability risks at a fraction of the cost compared to other European nations.

If you want to optimize your cost of living in Berlin even further, consider spreading your coverage across different insurers. We did exactly that to secure the cheapest premiums for each type of insurance. Our total monthly cost for contents, liability, and dental insurance is 87.79€.

Personal Liability Insurance

Personal liability insurance is one of the most important types of coverage to have in Germany. Although it’s not legally mandatory, it is considered essential for financial protection against damage you may cause to other people or their property, whether accidentally or through negligence.

Also, some landlords may even require personal liability insurance as a condition of your lease when renting an apartment. And it could even be necessary for certain jobs or activities. Let’s just say it’s not compulsory like health or car insurance, but it is very common and highly recommended!

We’re covered by Getsafe for 6.49€ on a family plan, insured up to 30 million euros with zero deductible. You can pick from hundreds of insurers offering personal liability coverage, but many only provide customer support and policy documents in German.

So if you’re not fluent yet, consider getting expat-friendly personal liability insurance through Feather. Everything, from policy documents to customer support, is in English, and plans start from just 4.94€ per month.

The cost of personal liability insurance varies based on coverage limits, where you live in Berlin, how many people are included in the policy (such as a partner, children, or parents), and whether you’ve previously had liability insurance in Germany.

Previous claims can also influence the premium, so it’s worth using Feather to help compare different options to find the best plan for your needs.

🔥 Bonus Tip: Sign up for personal liability insurance with GetSafe and get a 15€ credit automatically applied to your future premiums.

Contents Insurance

While not mandatory, contents insurance is a smart choice if you own valuable possessions. It covers your belongings against risks like water damage, burglary and vandalism, fire and smoke, and even theft anywhere in the world with an optional add-on.

The cost of contents insurance depends on several factors, including the size of your living space (measured in square meters or square feet), your address in Berlin, the total amount insured, your chosen deductible, and whether you have any home security devices installed.

Your premium may also be influenced by whether you’ve had contents insurance in Germany before and any previous claims you’ve made. So it’s worth using Feather to help compare different options to find the best coverage for your needs.

Our contents insurance costs 7.41€ a month and covers a total of 20,000€, with individual items insured up to 5,000€. This coverage came in handy when I once claimed for a wedding ring while on vacation. My insurer, Lemonade, processed the claim quickly and paid out with no deductible.

🔥 Bonus Tip: Sign up for contents insurance with GetSafe and get a 15€ credit automatically applied to your future premiums.

Dental Insurance

If you want to avoid high out-of-pocket dental costs, supplementary dental insurance is worth considering. Providers like Ottonova and Getsafe help cover treatments not fully reimbursed by public health insurance.

Dental insurance premiums are calculated based on factors such as your age, which public health insurance provider you have, any pre-existing dental conditions or planned treatments, and the level of tooth replacement coverage you choose (e.g., 80%, 90%, or 100%).

We’re covered through Feather and pay a total of 73.89€ per month (26.20€ for my wife and 47.69€ for my cover). I opted for more comprehensive dental care coverage because of my bruxism condition, which increases wear and tear on my teeth.

My plan covers 100% of unlimited professional teeth cleaning (PZR) per year and provides full coverage for dental treatments such as fillings, root canals, crowns, bridges, implants, and cosmetic procedures like teeth whitening, veneers, Invisalign, and lingual braces. Treatment costs are even covered up to 5x the standard rate according to the German Dental Fee Schedule (GOZ) to ensure comprehensive dental care without financial worries.

But even if you don’t need extensive coverage like me, basic plans from 10€ that include two professional dental cleanings per year can be a smart choice. The annual premium often costs less than paying for the cleanings out of pocket, a win-win for your budget in Berlin.

💡 Useful Tip: If you’re new to Germany, sign up for dental insurance before visiting a dentist. Dentists document pre-existing conditions in your records, so any issues diagnosed before you get insurance won’t be covered under your supplementary plan. To maximize coverage, sign up as soon as you arrive in Berlin or before your first dental check-up.

Additional Cover

These are just a few of the many insurance options available in Germany. You can find a full list of different insurance options on our resource page, including exclusive special offers on:

- Legal Insurance

- Bike Insurance

- Disability Insurance

- Life Insurance

- Pension Insurance

- Travel Insurance

Internet Providers

If you’re reading this guide, it means you can’t live without the internet. Don’t feel bad, we also rely on the internet for pretty much everything we do.

Although the internet is not Germany’s strongest point (strange, right?), there is connectivity at the end of the tunnel. Just don’t expect uninterrupted service 100% of the time. Allow a 10% margin of error.

For Home

Germany doesn’t rank among the countries with the cheapest internet, but you don’t have to break the bank to get ‘reliable’ connectivity at home. Here are the top internet providers offering high-speed broadband plans in Germany:

- Vodafone ⭐ OUR PICK ⭐

- 1&1

- M-net

- Telekom (T-Mobile)

- O2 (Telefonica)

We chose Vodafone and pay 45€ per month for a 1,000Mbps cable internet line. This speed is more than sufficient for browsing the web, streaming movies, gaming online, and even running our online business from home.

🔥 Bonus Tip: Sign up for Vodafone with our referral link and get a bonus of up to 90€ paid directly into your account. You can also compare all internet providers offering DSL, fiber optic, or cable plans before signing up to ensure you’re getting the best deal.

For Mobile

Connectivity at home is important, but staying connected while you’re out and about is essential too. These are the top mobile providers offering reliable data plans in Germany:

We opted for Vodafone’s CallYa Allnet Flat S tariff, which costs 9.99€ every four weeks. It comes with 10GB of data, unlimited calls and SMS within Germany, 200 minutes or SMS to EU networks, and EU roaming. It’s ideal for staying connected both at home and while traveling across Europe.

💡 Useful Tip: It’s not uncommon to experience internet outages at home that can last for days. If this happens, you can contact your provider and request temporary mobile data while they work on the issue. We’ve previously had Vodafone send us mobile data while our home internet was down. So it might be helpful to have both your home and mobile internet provided by the same company, just in case!

Best Banking Options for Expats in Germany

The banking industry in Germany is highly competitive. So banks are constantly looking for ways to lure you in with the best deals tailored to your spending habits.

For us, the best deal is paying zero banking fees. Yep, 0€ per month! Since arriving in Berlin, we’ve been using N26 and Revolut mobile banks. And we haven’t paid a single fee, which helps us keep our cost of living low.

🔥 Bonus Tip: Looking for a credit card with no fees? The American Express PayBack credit card is an excellent choice! Not only is it FREE (with no monthly charges), but you also earn PayBack points, helping you save even more while living in Berlin.

Mobile Banks (with Zero Fees)

Mobile banks are a top choice among expats for their convenience and ease of access. You get a German IBAN, user-friendly app in English, and an account with no monthly fees, making it perfect for managing your finances without the hassle of bureaucracy.

Here are some of the top mobile banks you can use in Germany, offering simple and fee-free banking right at your fingertips:

- N26 ⭐ OUR PICK ⭐

- Revolut ⭐ OUR PICK ⭐

- bunq ⭐ OUR PICK ⭐

- Tomorrow

- Vivid Money

Just bear in mind that these banks don’t have physical branches. So all your banking is done online or via their apps, which makes things super convenient but also means you won’t have in-person support.

Many of these mobile banks also offer paid plans, which typically include benefits like higher withdrawal limits, travel insurance, and additional perks to enhance your banking experience. Prices range from 3.99€ to 50€ per month, depending on the features included.

🔥 Bonus Tip: Zero-fee accounts often have limits on features like free withdrawals or transfers. To maximize your benefits, consider opening multiple mobile bank accounts to extend your limits. And if you need a credit card but don’t want to open one, bunq offers a free prepaid card that works just like a credit card! Check out our bunq mobile bank review for all the details.

Traditional Banks

If you prefer in-person service at a branch or need a Girokonto (checking account) with access to a Girocard (German debit card), these are some of the top traditional banks in Germany:

Most traditional banks charge a monthly management fee for Girokonten. But some accounts may be free if you meet certain conditions, such as receiving a minimum monthly deposit (like your salary) or being under 30 years old. Generally, you can expect to pay between 1.90€ and 9.90€ per month for a checking account.

Gyms and Fitness Studios

If you’re looking to join a gym in Berlin, you’ll have endless opportunities to stay fit and active. With hundreds of gyms and fitness studios spread across the city, finding one that suits your lifestyle will be quick and easy.

The real challenge isn’t finding a gym, it’s deciding which one to join! Since no single company dominates the city, gyms are constantly competing to offer the best deals, leaving you to work out which deal is the best for your budget.

A 12-month membership at popular gyms like McFit, John Reed, SuperFit, and FitX costs no more than 30€ per month. For premium options like Fitness First, Gold’s Gym, or Holmes Place, expect to pay at least 60€ per month.

And if flexibility is your priority, Urban Sports offers access to multiple fitness studios across Berlin with memberships starting at 24€ per month.

Here’s a quick list of some popular gyms and fitness studios in Berlin:

We chose to go with Holmes Place because their fitness studios feature a sauna, pool, and a quieter environment compared to the more crowded, budget-friendly gyms. Our memberships set us back 99.90€ per month for access to all clubs countrywide. But at just over 3€ per day, it’s still a small price to pay for a premium experience. After all, your body is your temple.

🔥 Bonus Tip: If you’d like to try out Holmes Place for yourself, we’re giving away a free weekly pass that grants you access to any of their gyms in Berlin. Just send an email with the referral code ‘NomadAndInLove’ to claim your free pass, and get a taste of the premium gym experience.

Cost of Entertainment: A Night Out in Berlin

Eating out, clubbing, exploring Christmas markets, and entertainment in general all costs money. The frequency at which you partake in these things will determine the amount of money you should budget.

As the cost of living in Berlin is lower compared to other European cities, you’ll be pleasantly surprised that things generally cost less. Here’s a range of prices from lowest to most expensive you can expect to pay for a night out in Berlin:

| Entertainment | Range (Low to High) |

|---|---|

| Meal for Two (including wine) | 40€ – 250€ |

| Night Club Entrance | 8€ – 30€ |

| Glass of Wine | 5€ – 12€ |

| Cocktail | 6€ – 15€ |

| Beer | 3.50€ – 7€ |

| Movie | 6€ – 18€ |

| Fast Food | 3€ – 15€ |

| Theatre | 20€ – 200€ |

| Cup of Coffee | 3€ – 6€ |

As you can see, the cost of a night out in Berlin varies widely. So how much to budget will depend on where your preferences lie within the low and high ends of these ranges.

We typically spend around 300€ per month on entertainment, which includes dining out at least once a week. And since public drinking is allowed in Berlin, we often grab cheap pre-drinks from a Späti (late shop) on our way to a night out, saving money along the way.

🗺️ Bonus Tip: Here’s a map with all our favorite places to eat in Berlin. It features the best restaurants for German food, Asian cuisine, our favorite döner kebab spots, fast food joints, the best places for cakes and desserts, and more.

Dog Ownership Costs in Berlin

In the winter of 2022, we adopted a dog from Macedonia. A decision that changed our lives. Or rather, rescued our hearts! Our family grew not just in size but in love, and he’s now an irreplaceable part of our household.

Of course, owning a pet also comes with its own set of expenses. These can vary greatly depending on your pet’s size, breed, age, and the number of furry companions you have.

We feel incredibly lucky to have rescued Franky, a small dog who fits perfectly into our lives. He joined us at just two years old, weighing under 7 kg. Ideal for our apartment size and the time we can devote to his care. On average, we spend 86.87€ per month on our dog.

The main costs to consider include taxes, pet food, and animal insurance. These expenses can add up quickly and should be factored into your cost of living budget if you’re planning to own a dog in Berlin.

Related Guide: Curious about the adoption process and the costs involved? Check out our detailed dog adoption in Berlin guide.

Pet Food

The amount you’ll spend on pet food depends largely on the size of your pup. If Franky had his way, we’d be bankrupt by now! As a general rule, the bigger the dog, the more food you’ll need to budget for.

Since dogs have limited lifespans, we’re dedicated to making sure Franky eats healthy. So we prepare a variety of fresh foods for him, including vegetables, lean meats, and fruits from the supermarket.

In addition to home-cooked meals, we spend around 20€ per month on high-quality dry pet food from Fressnapf, Germany’s largest pet food retailer.

This nutritional dry food is mixed into his meals, making it easy to transition him to pellets when we travel or leave him with a pet sitter. It’s especially handy when staying overnight at dog-friendly hotels without access to a kitchen.

Thankfully, dog food is readily available at supermarkets and specialty pet stores across Berlin, giving you plenty of convenient options. And if you prefer shopping online, you can’t go wrong with Zooplus.de, Germany’s leading online retailer for pet food and supplies.

Berlin Dog Tax (Hundesteuer)

Your furry friend can’t just laze around all day, they need to contribute to society too! Believe it or not, dogs in Berlin pay taxes. Yes, you read that right: dogs in Berlin are also taxpayers.

The dog tax (Hundesteuer) is 120€ per year for the first dog and 180€ per year for each additional dog. Since we only have one dog, we pay 120€ annually. If you’re considering owning multiple dogs, make sure you budget for the increased tax rate.

The good news is that you don’t have to pay it all at once. You can pay the dog tax quarterly, making it a bit easier to manage alongside your other living expenses.

💡 Useful Tip: If you adopt a dog from a registered shelter, you may be exempt from paying dog tax for up to 5 years! This is a great way to save while giving a deserving dog a forever home. Check out the Berlin Dog Tax FAQ page to learn how you can benefit from this exemption.

Dog Insurance

Just as health insurance is essential for us, pet health insurance is equally valuable for your pet. It helps cover veterinary expenses, especially if your pet has unexpected medical needs.

In addition to pet health insurance, we also have dog liability insurance. While liability insurance isn’t mandatory in Berlin like in some other German states, it’s a smart choice to protect yourself from potential damage caused by your dog. For example, if your dog were to damage property or injure someone, this insurance can cover the costs.

We’re covered for both types of insurance through Agila and pay a total of 56.87€ per month (52.79€ for pet health and 4.08€ for dog liability). Bear in mind that pet insurance costs can vary depending on your dog’s size, breed, and age. So be sure to shop around for the best coverage for your pup.

Vet bills aren’t cheap, but our pet health insurance covers 80% of the costs. You can choose more comprehensive coverage, but you’ll pay higher premiums for the added protection. If your dog has a history of health issues, it might be worth considering a more extensive plan.

Dogs can be unpredictable, and it’s always better to be prepared. For instance, Franky once scratched a neighbor’s leg. When they asked us to cover their medical bills, our dog liability insurance stepped in and paid the entire amount (less an 80€ deductible), plus 250€ compensation for pain and suffering (Schmerzensgeld).

Here’s a list of some of the top companies that offer pet health and dog liability insurance in Germany:

💡 Useful Tip: Want dog insurance in Germany without the hassle of German paperwork? Check out Feather Insurance for English-language support and advice on finding the best coverage for your pooch.

Other Costs to Consider when Living in Berlin

When you move to Berlin, there are a few unexpected costs that might pop up on your radar. While rent, groceries, transport and healthcare are the usual suspects, there are some other things you’ll want to budget for.

From mandatory taxes to your daily coffee fix, here’s a quick rundown of what else you might need to budget for when living in Berlin.

Germany TV Tax

If you haven’t heard about it yet, then we’ll be happy to be the horse’s mouth. TV Tax in Germany is a real thing! So don’t be surprised when you receive a letter in the post requesting payment after you move into your new home.

The TV license fee works out to 18.36€ per month, and you can pay it quarterly, semi-annually or annually. There are ways of avoiding the fee, but rather budget for it so there are no surprises when you arrive in Berlin.

Find out how it works and whether you’re exempt from paying in our Germany TV Tax guide.

Coffee

Another expense to consider is coffee. That’s because coffee-drinking culture in Berlin is ‘huuuge’! It’s simply a way of life. At 3€ to 6€ per cup your monthly coffee habit can easily exceed 100€, blowing the lid off your cost of living wide open.

We brew our own coffee every morning using a coffee machine and barista accessories we bought on Amazon. At less than 0.80€ per cup, we keep our costs in check, while sipping on the best lattes in Deutschland.

Learning German

What about learning German at a language school in Berlin? That can cost anywhere between 229€ to 750€ per month. Yup, learning German is an investment. But don’t worry, you can also use these 22 free ways to learn German online.

If you’re looking for even more tips, strategies, and in-depth reviews to help you improve your German, be sure to check out our full collection of Learning German guides. From honest reviews of apps like Duolingo and Busuu to exploring whether Lingoda is the right fit for you, we cover a wide range of resources to help you learn German effectively.

So whether you’re curious about creative, free ways to study or wondering how online classes compare to language schools, you’ll find valuable insights to guide your language journey and resources that best fit your learning style.

Taxes and Social Security Contributions in Germany

In Germany, a portion of your gross income (Brutto) is automatically deducted for taxes and social security contributions by your employer. What remains after these deductions is your net income (Netto).

For instance, if your gross salary is 3,000€ per month, your net income could be approximately 2,326.58€, depending on your tax class and pension contributions.

The amount you pay for taxes and social welfare (including pension and unemployment insurance) depends on your income level, with tax rates ranging from 0% to 45%.

💡 Useful Tip: You might need to pay Church Tax (Kirchensteuer) depending on how you register when you first arrive in Germany. Not keen on paying more tax? Then check out our How to Get Anmeldung in Germany guide to find out how to avoid it.

Tax Calculator

Use this online tax calculator to calculate your exact net salary and to get a clearer picture of how much disposable income you’ll have for living expenses.

Pension Calculator

Planning for retirement in Germany starts with understanding how much income you’ll need in the future.

Use this online pension calculator to estimate how much you can expect to receive from the German pension system and identify potential gaps in your retirement income. It’s a practical tool to help you plan ahead and ensure financial security in your later years.

While the German pension system provides a foundation for retirement, it may not be sufficient to cover all your living costs.

Local retirees we’ve spoken to have expressed concern about rising inflation and increasing expenses over time, highlighting that pensions often fall short of providing enough for a comfortable and secure retirement.

As part of your income is automatically allocated to social security and pension contributions, it’s wise to supplement this with additional investments to ensure financial stability well into retirement.

💡 Useful Tip: Open an investment account with eToro to take advantage of 0% commission on stocks. It’s a simple, cost-effective way to build a diversified portfolio and safeguard your financial well-being at retirement.

Monthly Expense Breakdown: What We Spend Living in Berlin

We’ve been living in Berlin for over six years now and have settled quite well into our new life as expats. During this time, we’ve worked out that living here is surprisingly affordable compared to many other in-demand cities around the world.

If you’re curious about just how much more affordable Berlin is, check out our Living in London vs Berlin guide.

For us, Berlin takes the top spot as one of the most affordable, expat-friendly, and in-demand cities to live in Europe. But don’t just take our word for it, decide for yourself!

Here’s a summary of our monthly expenses for two people and our pet dog in Berlin, ordered from highest to lowest cost. This breakdown gives you a clear idea of how affordable living costs are in this vibrant city.

| Monthly Expenses | Provider | Amount |

|---|---|---|

| Rent | 100m2 Apartment | 1,385€ |

| Health Insurance | TK | 900€ |

| Groceries | Rewe / Edeka / Alnatura | 600€ |

| Nebenkosten (Utilities) | N/A | 435€ |

| Entertainment | N/A | 300€ |

| Gym | Holmes Place (try with Free Weekly Pass) | 199.80€ (99.90€ per Person) |

| Public Transport | BVG (valid country-wide) | 116€ (58€ per Person) |

| Electricity | Ostrom (get 100€ Sign-up Bonus) | 75€ |

| Dental Insurance | Feather | 73.89€ |

| Transport (Moped) | Dance (get 50% OFF for 3 months) | 63.99€ |

| Pet Insurance | Agila | 56.87€ |

| Internet (1,000Mbps) | Vodafone (get 90€ Sign-up Bonus) | 45€ |

| Pet Food | Fressnapf (get 12% OFF) | 20€ |

| Mobile Phone Minutes & Data (200 min & 10GB) | Vodafone CallYa | 19.98€ (9.99€ per Person) |

| Germany TV Tax | Rundfunkbeitrag | 18.36€ |

| Tenants’ Association | Berliner Mieterverein | 11€ |

| Dog Tax | 120€ Paid Annually | 10€ |

| Home Contents Insurance | Lemonade | 7.41€ |

| Private Liability Insurance | GetSafe (get 15€ Sign-up Credit) | 6.49€ |

| Investment Account | eToro (0% Commission on Stocks) | 0€ |

| Bank Account | Revolut & N26 | 0€ |

| Credit Card | American Express | 0€ |

| Coffee | Amazon | 0€ |

| Total | 4,343.79€ (2,171.90€ per Person) |

Wrapping Things Up

We’re a married couple living in a 100-square-meter apartment in Berlin’s A zone (inside the ring), and we also have a small dog. On average, we spend 4,343.79€ per month on living costs, which breaks down to about 2,171.90€ per person.

Whatever your reason for moving to Berlin, we hope this cost of living guide helps you decide if the city is the right fit for you. We’ve packed it with valuable insights and cost breakdowns, so be sure to bookmark this guide so you have it handy whenever you need it.

If you do choose to make the move, here are some great deals on essential services and resources to help you get started.

Before making the big leap, be sure to check out our guide, How The ‘Unorthodox’ Netflix Series Reveals 10 Truths About Living in Berlin, for more insight into what it’s really like to live in the city.

Related Guide: It’s no secret that the cost of living in Berlin (and Germany as a whole) is rising. But don’t worry, there are easy ways you can cut down costs without sacrificing quality of life. Check out our How to Save Money in Germany guide for 14 easy tips to lower your living expenses.