If you’re looking for the best prepaid card to travel with in 2024, Revolut has it all, and more! Get FREE ATM withdrawals around the world and buy foreign exchange at the cheapest rates.

It feels like an eternity ago since our first Revolut card was delivered in the post. To be honest, we tried several other mobile bank cards including Bunq, Monese, Starling, Monzo, and N26. We simply couldn’t be sure which one was the best. We had to try them all.

Since then, we’ve travelled the world and used this time to try every nook and cranny of the Revolut app. And after a year, we came to the conclusion that Revolut is simply the best travel card we’ve ever used.

This review covers why the Revolut travel card is better than it’s competitors. It also lists 7 honest reasons why you should never travel again without ordering your travel card today.

So without further ado, here’s why you should try out the best travel card for yourself.

What is Revolut and How Does the Travel Card Work

If you’ve heard of Revolut, you can move right along. Your time should be spent in the next sections finding out why you should get the best travel card.

But if you’ve never heard of it or you’re wondering how does Revolut work, we’ll be happy to enlighten you.

Revolut claim to be a Fintech company that offers banking services in several countries across the world.

We figured they don’t call themselves a bank because they don’t actually have any branches where you can walk into. The magic happens in the Revolut mobile app which is how you manage your money.

We’d personally like to think of Revolut as a mobile bank that truly is, as they claim, radically better.

They offer a prepaid travel card jam packed with amazing features, which we can’t wait to fill you in on. You’ll receive a Visa or Mastercard and get to manage everything from spending to withdrawals all from the app.

Let’s jump straight into what you get with the Revolut travel card.

Note: You can access the full list of countries where you can get a Revolut card here.

Revolut Travel Card Review: Why You Need to Get the Best Travel Card

The moment of truth has finally arrived! Here’s why you should get the Revolut travel card today. You can thank us later.

1. A Prepaid Card with No Hidden Fees

Why pay bank fees when you don’t have to?

You get free benefits with Revolut’s transparent standard pricing plan. It’s not the first mobile bank to offer free stuff and certainly won’t be the last. This is simply how they attract customers.

But what really sets Revolut apart vs mobile banks such as N26, is that you’re getting a lot more value. And it’s absolutely free!

Here’s what you’ll get for FREE with a Revolut travel card on the standard plan:

- Free local bank account (Euro IBAN for EEA residents)

- Spend in 136 currencies at the interbank exchange rate

- Exchange in 36 currencies up to £1,000 / €1,000 / $1,000 / A$2,000 per month with no commission

- Free International ATM withdrawals up to £200 / €200 / $400 (Out-of-Network ATMs) / A$350 per month

Just stick to these limits when you travel and you’ll never have to pay any bank fees again.

The best way to stick to these limits is to budget. We always estimate our travel costs to make sure we don’t over spend and pay any fees.

Tip: If you’re travelling in a group or as a couple, you should each consider getting a Revolut travel card. You’ll increase your limits if you spend collectively.

Note: The interbank exchange rate is what banks use to swap or exchange currencies. It’s a real-time or live rate, which is why it is constantly changing in the Revolut app.

2. Get the Best Exchange Rate and Pay Zero Commission

If you’re travelling abroad, you’ll likely need foreign currency to fund those excursions and new experiences.

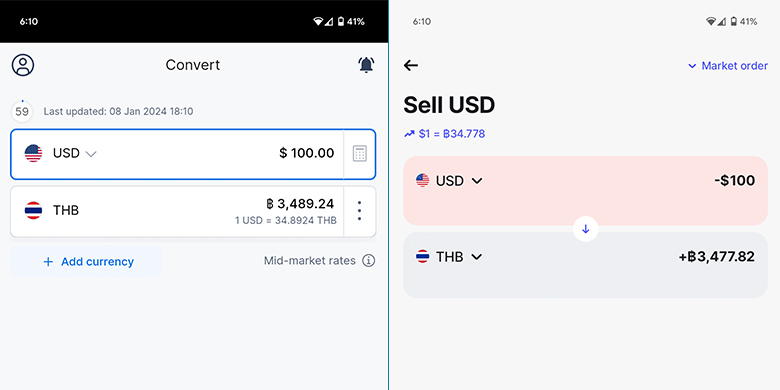

With Revolut you can now exchange currencies in the Revolut app at the real interbank exchange rate. That’s like getting the same rate you see on Google or on apps such as XE.

Yeah, you read that right! Don’t believe us? See for yourself!

If you need foreign currency (Forex) for your travels, simply exchange currency in the app to lock in the best rate. Just bear in mind that Revolut charges fixed rates when exchanging currency on weekends. So that’s between 5pm New York time on Friday and 6pm New York time on Sunday. Keep reading to learn how to buy Forex on the app.

Useful Tip: To guarantee the best rates and avoid foreign transaction fees, only exchange currencies on weekdays between 6pm New York time on Sunday and 5pm New York time on Friday. Check the current time in New York.

Note: Exchanging currency on the weekend or if you’ve exceeded your exchange limit on the Standard Plan will incur an extra 1% fee (0.5% on the Plus Plan). But we can assure you that these are still the best rates you’ll find anywhere even if you have to exchange on the weekend. You can find more information about Revolut exchange rates here.

3. Free and Easy to Top Up Your Revolut Prepaid Card

Saving money with Revolut sounds awesome, but how exactly do you buy Forex for travel with your local currency?

You get a free virtual card or you can order a prepaid debit card with your Revolut account. Depending on where you live, you may either get a Mastercard, Visa card, or Maestro card.

As Revolut doesn’t have any branches (remember, it’s a mobile bank), you’ll have to load your Revolut card using your existing bank account. Luckily, there are several ways you can add money to your Revolut account.

The easiest way to top up your Revolut card is by using a debit card. Simply add your card details in the Revolut app, insert an amount, submit and your funds will appear instantly.

You can top up your Revolut account using a debit card in 17 different currencies. Revolut adds new currencies from time to time, but here is the list of currencies they currently support:

- AUD – Australia

- BGN – Bulgaria

- CAD – Canada

- CHF – Switzerland

- CZK – Czech Republic

- DKK – Denmark

- EUR – Euro

- GBP – United Kingdom

- HKD – Hong Kong

- HUF – Hungaria

- JPY – Japan

- NOK – Norway

- PLN – Poland

- RON – Romania

- SEK – Sweden

- USD – USA

- ZAR – South Africa

To get the most out of your Revolut travel card, top up with a debit card as it is usually free. Depending on the currency, they may add a fee of about 2%. But this will be clearly indicated before you confirm the top up.

Revolut fees are always displayed in the app before you top up, so you always know what you’re paying.

💡 Bonus Tip: To avoid paying conversion fees on your debit card, top up in your local currency. In other words, if your card is in USD, load your Revolut card in USD.

Note: You can also add money using bank transfer, with cash or cheque, and with Apple Pay or Google Pay. You can find more information about how to top up to your Revolut card here.

Save Me For Later

4. Free Worldwide ATM Withdrawals

If you’re loving the top 3 tips, tip #4 is the cherry on top. Free cash withdrawals!

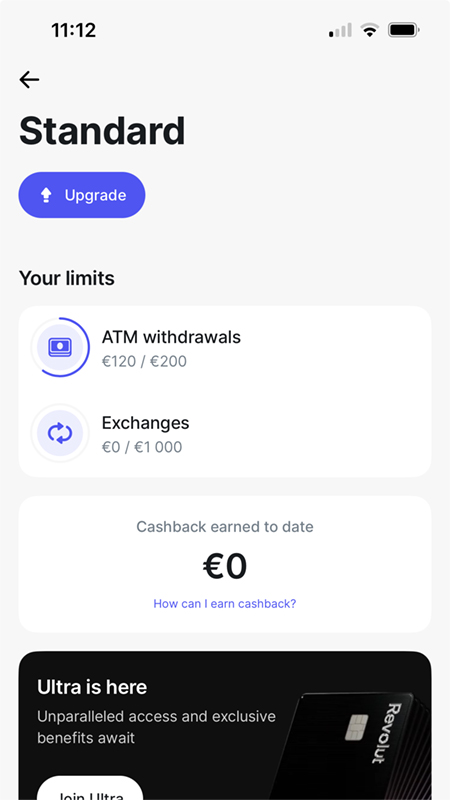

Revolut gives you free ATM withdrawals up to the equivalent of £200 per month on the standard plan. It’s €200 if you live in the European Economic Area (EEA), $400 at Out-of-Network ATMs for Revolut card holders living in the USA, and A$350 for residents of Australia.

These limits seem to be the same compared to what other mobile banks offer with their free standard plans. So it’s not quite enough to classify it as the best travel card.

But Revolut makes their deal a whole lot sweeter. Their travel card includes worldwide withdrawals in their ATM limit, giving you access to your money abroad.

This means that you can also withdraw foreign currency to the equivalent of the monthly ATM withdrawal limit (£200, €200, $400, A$350).

And what’s really cool is that you can monitor your monthly ATM withdrawal limit balance all in the Revolut app. It’s really a great way to stay on top of your limits.

Just be wary of cash machine operators. Some of them may charge you an extra withdrawal fee on top of the normal fees. Luckily, these charges are usually displayed on the screen before you accept.

Knowing which ATM to use will certainly save you a ton of money on your travels. Simply check out the Revolut Community to search for a list of ATMs that don’t charge any fees.

Useful Tip: If you’re withdrawing Forex, make sure you calculate the amount in your local currency before heading to the ATM. Or you may go over your free limit and pay a 2% withdrawal fee above this amount.

5. Exchange and Hold up to 36 Currencies with No Commission

While we love travelling the world, we hate the thought of having to buy Forex before our trips. But with Revolut, you can exchange and hold 36 different currencies all in one card.

And the best thing is that there aren’t any hidden fees or commissions if you stay within your limit. You get £1,000 / €1,000 / $1,000 / A$2,000 per month with your travel card on the Standard Plan. But you’ll have to pay a 1% fee (0.5% on the Plus Plan) if you exceed this limit.

The Revolut card removes all of the stress of carrying all your Forex with you on your trips. What’s even better is that you’ll never have to walk into a ‘bureau de change’ ever again.

Here’s the full list of currencies you can exchange and hold on your card:

- AED – United Arab Emirates

- AUD – Australia

- BGN – Bulgaria

- CAD – Canada

- CHF – Switzerland

- CLP – Chilean Peso

- COP – Colombian Peso

- CZK – Czech Republic

- DKK – Denmark

- EGP – Egyptian Pound

- EUR – Euro

- GBP – Great Britain

- HKD – Hong Kong

- HUF – Hungaria

- ILS – Israel

- INR – Indian Rupee

- ISK – Iceland

- JPY – Japan

- KRW – South Korean Won

- KZT – Kazakhstani Tenge

- MAD – Moroccan Dirham

- MXN – Mexico

- NOK – Norway

- NZD – New Zealand

- PHP – Philippine Peso

- PLN – Poland

- QAR – Qatar

- RON – Romania

- RSD – Serbia

- SAR – Saudi Arabia

- SEK – Sweden

- SGD – Singapore

- THB – Thailand

- TRY – Turkey

- USD – USA

- ZAR – South Africa

Tip: Exchanging currencies back to your local currency also uses up your limit. So monitor your limits in the app so you don’t exceed them. You may also want to consider waiting for your limits to reset in the next month to avoid paying fees.

6. Spend in 136 Currencies

If like us, you love exploring hidden gems and you find that you can’t hold the currency of the country you want to travel to, don’t despair. Revolut has you covered! There’s almost no place on earth where you can’t use your Revolut card.

You can use your card to make payments in 136 currencies. So pretty much any where Mastercard and Visa is accepted.

Revolut simply uses the interbank exchange rate to process your payment. In other words, they use the available currency on your travel card and exchange it using this exchange rate. And that’s how you’re able to pay for your stuff abroad.

The real game changer here, is this exchange rate. It’s the live rate you see on Google or in your Forex app. And it’s yet another reason why Revolut is the best travel card on the market.

Useful Tip: If you can’t hold the currency you want to pay with on your Revolut card, always pay in USD. The USD is the most traded currency on the planet. This means that you’re most likely to get the best conversion rate if you pay using USD.

Note: You can access the full list of currencies supported by Revolut card here.

7. Your Money is Safe with the Revolut App

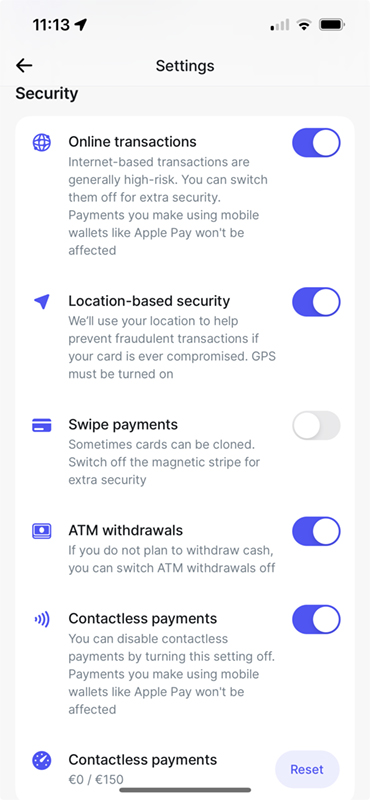

Revolut doesn’t have any physical branches, so you won’t need to worry about bank heists (just kidding). The app is your bank and because of that, you get card security like no other.

You’ll get an instant notification the second you make a payment with your card. You’ll also have full control of all your cards, allowing you to freeze, adjust limits and even change your pin.

And if you really need to speak to someone, you get chat support 24/7 to resolve any issue you encounter. It’s like having a bank round the clock at your fingertips.

💡 Bonus Tip: For extra security, use the Revolut virtual card to safely pay for your travel adventures. You can freeze it as soon as you’ve complete the transaction. You can also use your virtual card for those 30 day trials we always forget to cancel and end up paying for.

Unlock More Benefits with Revolut Paid Plans

Revolut offers you a whole lot more than just the best travel card on the market. We’ve only told you why the card is great for travel.

To be honest, we’ve just scratched the surface because there are many more reasons to use Revolut.

With Revolut’s paid plans, you can get insurance, invest in shares, transfer money abroad, get rewards and more. The list just goes on.

Related Guide: Revolut is not only the best travel card. It’s also great for trading and investment too! Find out how we use Revolut to deposit money to the trading app Binance for FREE and use the savings to grow our investment portfolio.

Revolut has changed the way people bank and that’s the reason why we’ve made the best travel card our only card.

Here’s a comparison of the travel benefits you get with the different plans that Revolut offers:

| Travel Benefits | Standard | Plus | Premium | Metal | Ultra |

|---|---|---|---|---|---|

| Fee-Free ATM Withdrawals | 200/month | 200/month | 400/month | 800/month | 2,000/month |

| Airport Lounge Access | Discounted | Discounted | Unlimited | ||

| Trip Cancellation Insurance | |||||

| Fee-Free Currency Exchange | 1,000/month | 3,000/month | no limit | no limit | no limit |

| Global Medical Insurance | 10m/year | 10m/year | 10m/year | ||

| Car Hire Excess Insurance | 2,000/year | 2,000/year | |||

| Luggage Insurance | 1,000/year | 1,000/year | 1,000/year | ||

| Winter Sports Insurance | 3,000/year | 3,000/year | 3,000/year | ||

| Personal Liability Insurance | 1m/year | 1m/year | |||

| Priority Customer Support | |||||

| Sign Up | Free | Get Plus | Get Premium | Get Metal | Get Ultra |

Disadvantages of Revolut Travel Card

If you’ve read this far, you’re either sold and can’t wait to get your hands on the card. Or, you’re starting to suspect that we work for Revolut. We don’t blame you, we would too!

Honestly, what Revolut offers is just brilliant! And there’s simply nothing else out there we’ve tried that even comes close.

But not everything is perfect. There are certain things Revolut can improve, and it’s only fair that we share them with you.

1. Live Chat Customer Support Response Time

Although their live chat customer support is extremely helpful, we find that they sometimes take a little too long to respond.

On some days you may wait 5 minutes for a live agent, but on another day it can take up to an hour.

Their response time is simply inconsistent but we hope they improve this by connecting us to a live agent faster.

2. No Credit Card Top Up

Revolut stopped allowing credit card as a payment method for top ups on 8th July 2022. So you can no longer top up your Revolut travel card with a credit card.

But we must admit that we miss the convenience of topping up our Revolut card using a credit card.

So if like us you just can’t wait to go on holiday or maybe you also get great rewards for using your credit card, Wise is the only other travel card that accepts credit card top ups.

3. Limited Ways on How to Contact Revolut

As you already know, Revolut offer its services only via their app. That means they don’t have any branches you can walk into if things go pear shaped.

So if your mobile phone is lost, you won’t be able to contact Revolut without installing the mobile app on another device.

We hope they address this by offering email support or a website based chat support in the future.

Revolut Alternatives

There are clearly advantages and disadvantages of getting a Revolut card. We still firmly believe that it is the best travel card on the market. But if you want to explore other options, here are a few alternatives to Revolut:

Wrapping Things Up

We’ve given you more than 7 reasons why Revolut is the only travel card you’ll need in 2024. But don’t take our word for it, try it for yourself! Sign up for Revolut today and order your free virtual card to start.

If you need a reminder of why you should sign up for Revolut, here’s a summary of why we think it’s the best travel card on the market:

- Free standard account with transparent fee structure

- Best exchange rates with no commission

- Free and easy to top-up

- Free worldwide ATM withdrawals

- Exchange and hold up to 36 currencies

- Spend in 136 currencies

- End-to-end full stack app security

Are you planning a scuba diving trip? Or maybe you’re planning to spend the summer in Greece? Whatever your plans are, make sure you take your Revolut card with you on your next adventure.

If you need any more money saving tips on how to get the most out of your travel card, we’d love to hear from you so we can share all our secrets with you.