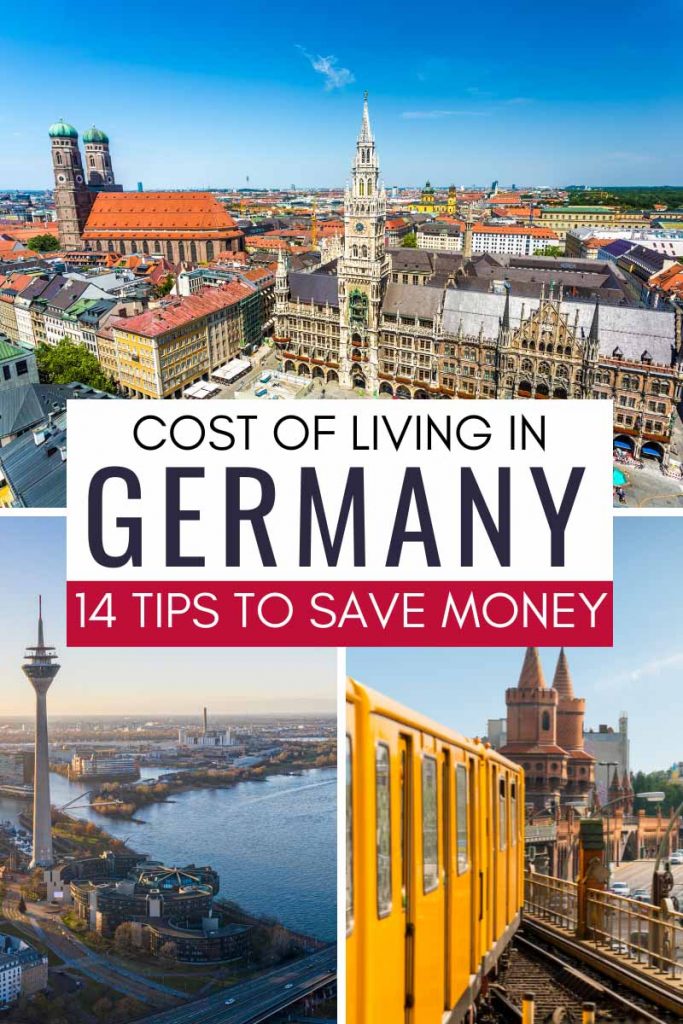

Expats share easy and actionable tips on how to save money and reduce your cost of living in Germany. From how to get a rent reduction, and cut down electricity costs, to how to save money buying food and groceries in Germany.

It’s no secret that the cost of living in Germany is rising. Especially if you live in cities like Berlin, Frankfurt, Cologne, Dusseldorf, Munich, or Hamburg.

Not only do you have to face rising food and energy prices, but your landlord wants a rent increase?!

As fellow expats living in Berlin, we know what you’re going through. Thankfully, there are things you can do to cut down costs without sacrificing quality of life.

These money saving tips go beyond cutting back. We’re not here to tell you to shop or dine out less. That’s ultimately your choice.

But what we will do though, is share how you can shop and dine out smarter so that you can still save money in Germany.

Get A Rent Reduction in Germany

No doubt the biggest living cost in Germany is renting an apartment. Depending on which city you’re living in, you can easily pay between 30% to 50% of your monthly salary on rent alone.

This means that any money you can save on rent can translate into HUGE cost savings.

And whilst it may not be common or easy to negotiate your rent in Germany. It doesn’t mean you can’t get a rent reduction after you’ve moved in.

We know it’s possible because we’ve personally done this ourselves and saved over €300 every month renting an apartment in Berlin. That’s a 25% reduction in our rent!

All legally (of course) and without us having to pay any lawyer’s fees too!

We’ve revealed exactly how we got a rent reduction in Germany with Conny (Wenigermiete) in a separate guide. As well as how you can easily check if you’re (illegally) paying too much rent for your apartment in Germany.

This tip won’t reduce your cost of living in Germany immediately. But it can potentially save you tons of money in the long term. Especially if you’re planning to live here for at least 3 years.

Change Electricity Providers in Germany

Now, this may not be the most obvious cost saving hack, especially for expats living in Germany. But you can save money (around €150 per year) simply by changing electricity providers in Germany.

Yup! If you’ve moved into an apartment in Germany and never switched your electricity provider and signed a new contract, now is the time to do so.

Your default electricity provider (otherwise known as the ‘Grundversorger’) will always charge you higher electricity prices.

How much higher, you ask? Well, in some cases, it can be almost DOUBLE the price. Yikes!

That’s why you should never go with the default option and switch your electricity provider as soon as you move into a new apartment in Germany. Unless your landlord has included electricity in your rent, of course.

And when your electricity contract comes to an end (after 12 or 24 months), you can potentially save money again by switching electricity providers (again).

Switching energy providers in Germany is surprisingly easy with few (if any) bureaucratic hurdles to jump over.

If you’re new to Germany, we’d recommend going with the electricity provider, Ostrom.

Not only do they offer English customer support and one of the first providers to go digital (i.e. no paperwork). But they’re also the only electricity provider in Germany that offers flexible, month-to-month electricity contracts.

Not sure how to make the switch? Don’t worry! Read our Electricity Providers in Germany guide. We share tips on how to pick the right energy company for you and how to compare prices.

Related Guide: Electricity costs in Germany are THE most expensive in the world. Make sure to use our German Electricity Costs guide for 9 actionable tips to save even more money living in Germany.

Save Money Taking Public Transport in Germany

Taking public transport in Germany instead of owning a car is obviously the cheaper choice. But did you know that the type of public transport ticket you buy matters too?

Picking the right public transportation ticket to suit your lifestyle can cut down costs by more than €300 a year living in Germany! And that’s the cost saving excluding the famous €9 train ticket.

If you’re working or studying in Germany for at least a year, buying a yearly subscription public transport ticket will be the cheapest.

And you can reduce costs further if you can avoid traveling during morning peak hours on weekdays with the 10AM Flexible Train Ticket subscription. That’s another potential €200 you can save every year!

If you frequently travel regionally within Germany, you can save money buying train tickets with the DB Bahncard.

Sure – you have to buy the DB Bahncard first. But if you take a minimum of 2 to 4 interregional train trips in Germany per year, the 25% to 50% discount will help you save more than what you paid for.

Save Even More Money Cycling in Germany

Cycling is one of the most popular ways to commute and get around in Germany for many reasons.

It’s often the faster way to get around the city, good for your health, great for the environment, and will save you TONS of money living in Germany. Between €650 to €750 a year to be exact!

The only problem? Bike theft!

That’s why instead of buying a bicycle, which can easily cost anything between €300 to €1,000+, we’ve opted to rent a bike via bike sharing instead.

We use Swapfiets and have been loving the freedom of getting around Berlin by bicycle! You basically get the benefit of owning your own bike for only €22.90 a month!

That’s a massive 60% cost saving compared to taking public transportation in Germany.

Choosing to cycle as your main mode of transport is a lifestyle commitment. That’s why we always recommend trying it out first before deciding.

Not sure which bike sharing to try in Germany? Don’t worry. Use our Berlin Bike Sharing guide to figure out how bike sharing works and which company offers the best value for money.

The prices may be slightly different depending on which city you’re cycling in in Germany. But it will still give you a good idea of which bike sharing to use for short rides, day trips, or even monthly bike rentals.

Related Guide: Make sure you know these 24 Cycling Rules in Germany, before hopping on that bike to avoid accidents and fines.

Get A Free German Bank Account With No Fees

You can easily save more than €100 of costs per year living in Germany simply by changing your bank account.

Why pay bank fees when you don’t have to?

And yes – German bank accounts with no fees (FREE) do exist! We use N26 as our free German bank account and Revolut as our free international bank account for traveling.

Just make sure you stay within the free withdrawal and transfer limits to pay no fees.

We’ve been using both of these expat-friendly digital banks for almost 4 years now. Find out our honest pros and cons of both these banks in our N26 Review and Revolut Travel Card guide.

Get a Free Credit Card in Germany With No Monthly Fees

We love our N26 and Revolut bank cards. But one thing they both lack is that they’re debit cards, not credit cards.

Debit card payments are sufficient for most day-to-day transactions. But if you want to book flights, car rentals, or hotels, then you might need a credit card.

We’ve been using the American Express PayBack credit card for several months now and absolutely love it! Not only is the credit card FREE (no monthly fees), but you also earn PayBack cashback points.

These PayBack points can be redeemed and spent like cash. So you could potentially save money every month on expenses you already need to pay to live in Germany!

💡Bonus Tip: Make sure you sign up to the PayBack Loyalty Program before you apply for the American Express PayBack Card. You’ll need the loyalty card to spend your PayBack points. Order your Free PayBack Loyalty Card and get 200 points to get you started.

You can spend PayBack points you earn with the American Express PayBack Card to buy food, groceries, and everyday essentials at shops such as Rewe, Penny, Alnatura, DM, and Fressnapf. Or on leisure and travel at PayBack partners such as H-Hotels.com, SunExpress, Sixt, and Best Western Hotels and Resorts.

💡Bonus Tip: Paying for all your monthly expenses with your American Express PayCard Card will maximize your PayBack cashback points. We’ve done just that and earn between €10–€20 in PayBack points every month.

Having a free credit card in Germany is convenient. But you must make sure that you don’t spend beyond your means and pay down your American Express PayBack card every month to avoid paying fees.

The only downside is that the app and website are only available in German. But the American Express customer service will gladly assist you in English if you need assistance. It’s not the most expat-friendly credit card. But the American Express PayBack Card is currently one of the only free credit cards in Germany that offer cashback points.

Useful Tip: We use Google Chrome’s automatic translator to manage and pay our American Express PayBack credit card. So even though their website is only available in German, you’ll get by just fine.

Save Money on Food and Groceries in Germany

Food and groceries in Germany are pretty affordable compared to most first-world countries. But there are tips and tricks to save even more money buying groceries in Germany.

Tip 1 is to download the apps for the supermarkets you visit the most and join their loyalty programs. Most supermarkets offer redeemable points as well as extra discounts if you have a loyalty card.

Tip 2 is to use the supermarket apps to compare the food and grocery discounts and specials of the week. We’ve often found weekly specials at mid-range supermarkets, like Rewe and Edeka, to be cheaper than shopping at discount grocery stores, like Aldi and Lidl.

Tip 3 is to buy food and fresh produce that are on sale or in season. We’ve found this tip particularly effective for saving money with the high inflation we’re experiencing in Germany.

Our final tip is to split up your grocery trips. Instead of buying everything at the closest and most convenient supermarket. Make a list of which weekly discounts to shop at each grocery store.

And for other daily essentials and food items you need that aren’t on sale. We’d recommend buying them at your discount supermarkets like ALDI, Penny, and Lidl.

💡Bonus Tip: Don’t buy food and groceries online if you’re trying to save money in Germany. We’ve noticed that weekly discounts aren’t available online. You’ll have to shop in-person to get the cheaper prices.

Use the ‘Too Good To Go’ App To Save Money Eating Out

Cooking your own food is obviously the best way to save money and reduce costs in Germany. But it’s not always possible with our busy lifestyles and ever-evolving tastebuds.

When the craving hits, we use Too Good To Go to eat out on the cheap. Not only is it a great way to save money, but it’s good for the environment too!

Buy perfectly good food at massive discounts before they’re thrown away from cafes, restaurants, and hotels near you. You can even buy groceries at discounted prices too.

With Too Good To Go, you won’t be able to pick the exact meal or food item you want. You’ll get a surprise or ‘magic bag’ with the yummy food left over at the end of the day.

We were a bit skeptical at first. But after trying it out ourselves, we’re sold! Where else can you eat out on the cheap for as little as €4 per person in Germany?!

Compare Insurance Providers in Germany

All seasoned expats know that Germany is famous for having all types of insurance. From the usual health, dental, life, and home contents insurance. To the less common but mandatory personal liability insurance, and dog liability insurance (yes – it’s a thing!).

Luckily, they’re plenty of insurance service providers in Germany to choose from. And they’re all competing for your business.

We use Check24 to compare and find the best deals. Not only can you compare insurance providers, but also mobile, internet, electricity, and gas suppliers. It’s pretty awesome.

We’d recommend comparing prices every year and switching when it makes sense. This simple tip could cut down costs and save you up to €300 a year living in Germany!

The only con of price comparison sites like Check24 is that they don’t always recommend the most expat-friendly providers. Most of them communicate in German only – which makes things tricky for expats still learning the language.

That’s why we recommend expats to get a quote from Feather Insurance. Not only does Feather Insurance offer customer service in English. But all your insurance policy documents will be in English too. So you’ll never have to worry about the language barrier again.

Here’s the different types of cover you can get from Feather Insurance:

- Public health

- Expat health

- Private health

- Dental

- Household contents

- Personal liability

- Bike

- Legal

- Job insurance

For a full list of the different types of insurance you may need in Germany, check out our Living in Germany resource page. We’ve included discount codes and special offers just for you.

Save Money Learning German

Learning German is an expensive but necessary investment for expats living in Germany.

Not only will it improve your chances of finding a job in Germany. But it’ll make integrating and settling into life in Germany a whole lot easier as an expat.

But attending a language school is a hefty expense. German language courses can cost anywhere between €300 to €750+ per month.

And you’ll need at least 6 months of intensive German language classes to get to a conversational level sufficient to apply for most jobs in Germany.

That’s equivalent to spending between €1,800 to €4,500 taking German language classes alone. Yikes!

But don’t worry. You don’t have to skimp out on learning German just because of the rising cost of living in Germany. There are free and creative ways you can learn German when you need to save money.

Check out our 22 free ways to learn German online for a list of free Youtube channels, language learning apps, online German courses, podcasts, and more to continue improving your language skills when money is tight.

File Taxes in Germany For Free

Filing taxes in Germany is mandatory. But paying hundreds of Euros for a tax advisor to do your taxes, isn’t.

As fellow expats whose German language levels are mediocre at best, we completely understand how intimidating it is to file your taxes in Germany in a foreign language.

It’s terrifying (we won’t lie), but not impossible. We managed to file our taxes in Germany (as freelancers) on our own for FREE and so can you!

Find out how we did it in our How to File Taxes in Germany with Elster guide.

Useful Tip: If you’ve run out of time and need to urgently file your taxes, we recommend using TaxFix. It may save you a ton of money compared to going to a tax advisor.

Find Free Things To Do in the City

Hanging out with friends doesn’t have to be expensive. There are plenty of free things to do in and around cities in Germany.

Go for a self-guided walking tour of the city, hiking in the nearby forests, or get together for a barbeque or picnic in the park. Socialising doesn’t have to break the bank.

If you’re an expat living in Berlin, check out our 19 Outdoor Activities in Berlin or 24 Best Things To See in Potsdam guide for inspiration.

Check If You’re Eligible For Student or Employee Discounts

One of the best ways to save money in Germany as a student or employee is to check what discounts you’re eligible for.

If you’re a student, we’d recommend checking out the website studentenrabatt.de to see what student discounts you can get.

You can get some pretty awesome discounts (10% to 40%) for laptops, mobile contracts, and music subscriptions, to buying clothes, shoes, and even protein powder.

If you’re working in Germany, find out from your employer if you’re eligible for any employee perks and discounts. Many companies in Germany offer their employees massive discounts on public transport tickets, gym memberships, and more.

Save Me For Later

Additional Ways to Save Money Living in Germany

One of the easiest ways to save money fast is to manage your monthly subscriptions. Go through your bank statement and make a list of all the subscriptions you have. Then critically assess which ones you least use (or don’t need) and cancel them.

Shower at the gym if you already have a membership. This will save you money with the rising prices of hot water, gas, and heating in Germany.

If you’re saving money to invest in Germany, then make sure to read our Top Investment Apps in Germany guide. We’d put together a list of free apps you can use to invest in Germany and share the pros and cons of each platform.

And lastly, check out our Resources for Living in Germany. We’ve included discounts and promo codes for some of the services we use in Germany.

14 Easy Tips To Save Money in Germany

That was a long guide. Here’s a quick summary:

- Get a rent reduction in Germany

- Change electricity providers in Germany

- Get the most cost effective public transport ticket

- Cycle instead of taking public transportation

- Get a free German bank account with no fees

- Get a free credit card in Germany with cashback benefits

- Join supermarket loyalty programs to save money on food and groceries

- Eat out with ‘Too Good To Go’

- Compare insurance providers in Germany

- Learn German online for free

- File your tax return for free

- Find free things to do in your city

- Make use of student or employee discounts

- Manage your monthly subscriptions