An expat’s guide to Germany TV Tax (or TV license fee) and what to do when you receive this letter from ‘Rundfunkbeitrag’. Find out whether you’re exempt from paying or how to easily pay online with our English step-by-step translations.

You’ve just overcome the challenging task of renting an apartment in Germany. Navigated the ocean of German bureaucracy and got your ‘Anmeldung’ done. And just as you thought you could breathe a sigh of relief and enjoy your new home, you receive a ‘Rundfunkbeitrag’ letter to tell you to pay your TV tax in Germany. And you’re thinking, ‘What the heck? I don’t even have a TV?!’

Don’t panic! It’s not as stressful as it first seems. You’ve come to the right place! As fellow expats living in Berlin, we TOTALLY understand what you’re going through.

So to make your life in Germany a little easier (we’ve all got enough stress and hassles to deal with already). We’ve taken the liberty to decipher all the official German websites, done the required research, and put together a comprehensive guide on what you need to know about paying TV tax in Germany.

This guide will explain what ‘Rundfunkbeitrag’ is, how much this ‘TV license fee’ is in Germany, whether it’s mandatory and how to tell if you’re exempt from paying. Plus, we’ve explained how you can easily pay your TV tax in Germany online and written step-by-step instructions in English so you can quickly tick this off your to-do list.

Related Guide: Did you know that you can save €200 and more on your electricity bill by signing up with a new provider? We kid you not! We recently did this ourselves. Find out how in our Electricity Providers in Germany guide where we explain how you can easily do the same.

What is Rundfunkbeitrag?

‘Rundfunkbeitrag’ is German for ‘broadcasting license fee’. So technically, it’s more than simply paying for a TV license in Germany because it covers radio broadcasting too.

You may have also heard people calling it ‘Germany TV Tax’ because you have to pay ‘Rundfunkbeitrag’ regardless of whether you own a TV or radio or not!

Yes – that includes us expats too. Even if you never watch the local TV channels because your German language skills are limited to ‘Tschüss’ and ‘Bis morgen’.

Related Guide: Looking for fun and FREE ways to improve your German? Read our 22 Ways To Learn German Online For Free to get a list of Youtube channels, podcasts, Netflix shows, language apps, and online language courses to learn at home.

Who Do You Pay German TV Tax To?

Since you’re paying ‘TV Tax’ in Germany regardless of whether you use it. You might as well know who, what and where your hard-earned money is being paid to, right?

The funds raised by paying your TV or broadcasting license fee are used to fund public radio and TV stations in Germany. These public channels are often not funded by ads or companies and are created to provide the public with independent, fair, and unbiased reporting. So no ‘fake news’ here!

And if you’re wondering which public radio and TV stations these are. It’s the ARD, ZDF, and Deutschlandradio.

What is Beitragsservice von ARD, ZDF und Deutschlandradio?

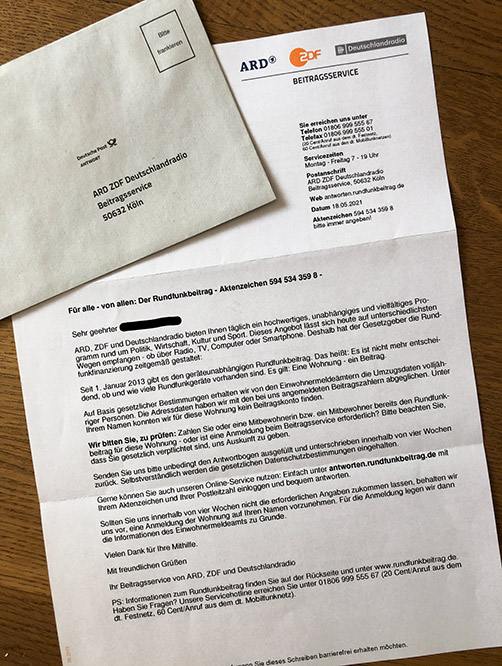

Okay, so now you know what ‘Rundfunkbeitrag’ is and received a letter to pay your German ‘TV tax’. But who is this ‘Beitragsservice von ARD, ZDF und Deutschlandradio’ that you see printed on the top right-hand corner of your Rundfunkbeitrag letter? Is it a scam?

Don’t worry, it’s legit. ‘Beitragsservice von ARD, ZDF und Deutschlandradio’ or ‘Beitragsservice’ for short, is the organization that is responsible for collecting this radio and TV license fee across Germany.

What is GEZ Germany?

If you’ve been living in Germany for a while. You may also have come across the name ‘GEZ Germany’ being mentioned when searching for more information on paying ‘Rundfundbeitrag’ in Germany.

The GEZ Germany, which stands for ‘Gebühreneinzugszentrale’ or fee collection center in English, was the previous organization that collected ‘TV tax’ in Germany before it was replaced by the ‘Beitragsservice’. So again, don’t worry. It’s not a scam.

Related Guide: It’s very common to come across scams when renting an apartment in popular cities of Germany like Berlin where demand is notoriously high. Make sure you read our 7 tips to spot and avoid Berlin apartment scams so you don’t become a victim of rental fraud.

Do You Have To Pay TV License in Germany?

So let’s answer the ultimate question that expats frequently ask, ‘Is it mandatory to pay TV tax in Germany?’.

Unfortunately – yes. Anyone living in Germany who is at least 18 years of age is legally required to pay ‘Rundfunkbeitrag’. So yes, that includes us expats who live in Germany too.

The good news, however, is that you only pay one TV license fee or ‘TV tax’ per household in Germany. So if you’re sharing a flat or living in a WG (‘Wohngemeinschaft’) with 2 or 3 other flatmates, only one person from the household is required to pay the fee. The same goes for a family who lives together, of course.

Basically, as long as you’re all living within the same apartment, you only pay one ‘TV tax’ in Germany regardless of how many people live in it or how many TV, radios, and other devices you do or do not have.

There are some cases where you may be eligible to pay a reduced TV license fee or be completely exempt from paying at all though.

Bonus Tip: If you’re renting a short-term apartment in Germany, make sure to ask the landlord whether the rent you’re paying includes German ‘TV tax’ or not.

Who Can Get Exempt From Paying TV Tax in Germany?

You may be exempt from paying TV tax or be eligible to pay only one-third of ‘Rundfunkbeitrag’ (i.e. €6.12 per month) in these cases:

- If you receive unemployment benefits II or social benefits (Hartz IV)

- If you receive disability benefits (severe vision or hearing disability)

- If you receive a pension

- If you’re a student who receives educational or training grants (BAföG) or vocational training allowances (BAB) and don’t live with your parents

- If you’re a US service member or family members that live in Germany under the SOFA agreement (Status of Forces Agreement)

And lastly, if you happen to have one or more secondary apartments or homes in Germany, only one ‘TV tax’ or license fee has to be paid.

Just bear in mind though that for each one of these exceptions, you’ll need to contact the Beitragsservice and apply to pay a reduced fee or be exempt from paying. It doesn’t happen automatically just because you receive certain benefits or fall under these categories.

If you do, you can easily apply for an exemption from paying ‘TV tax’ in Germany on their website. You can also contact the Beitragsservice by telephone at 018 59995 0400 if you’re confident speaking German.

Save Me For Later

How Much Is TV tax In Germany?

The German TV license fee or ‘TV tax’ costs €18.36 per month. You’re given the option to pay this amount every 3 months, every 6 months, or pay it all upfront for the entire year.

Whichever option you pick, just make sure that you pay within 4 weeks of receiving your Rundfunkbeitrag letter.

How To Pay ARD ZDF TV License Fee Online?

You read that right! Paying your ‘TV tax’ or ‘Rundfunkbeitrag’ in Germany is one of the few administrative tasks that you can do ONLINE! We know – it’s pretty rare. We couldn’t believe it either until we tried it ourselves.

The Rundfunkbeitrag website is only available in German though. But don’t worry! We’re going to walk you through paying your ARD ZDF TV License Fee online with our step-by-step English translations.

Related Guide: Did you find this Germany TV Tax guide useful? Then make sure you read our Electricity in Germany FAQ guide too. It may help you save some time and money when moving to Germany.

Step 1: Paying TV Tax in Germany Online

Grab the letter you received from the Beitragsservice and find the ‘Aktenzeichen’ or file number. You’ll find it on page 1 of the Rundfunkbeitrag letter just before they start the letter with ‘Sehr geehrter …’.

Then insert this number and your postcode (Postleitzahl) and click continue.

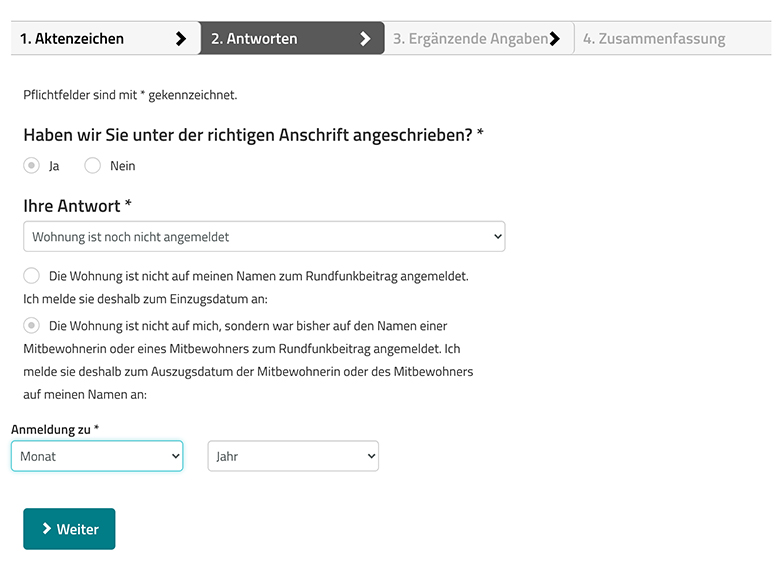

Step 2: Check That Your Address Is Correct

Check that your address as written on the Rundfunkbeitrag letter has been captured correctly. Then select ‘ja’ (yes) or ‘nein’ (no).

After you select ‘ja’, you’ll click the drop-down menu and see 2 options. The options are:

- My address has not been registered.

- My address has been registered.

If this is the first time you’re paying for ‘TV tax’ in Germany, you should select option 1. This question is asking whether you’ve registered this address with the Beitragsservice, not whether you’ve done Anmeldung or not.

After you select option 1, you’ll see more options pop up. Select the first option if you’ll be the person responsible for paying the TV license fee on behalf of your household. The second option is there if the person or roommate who was responsible for paying your German TV tax has moved out of the apartment. Then click the drop-down menu to select which month and year you moved into the apartment.

Select option 2 ‘Wohnung ist bereits angemeldet’ if a housemate or partner has already registered to pay for Rundfunkbeitrag for your shared apartment. Then select the first circle when given the next two options and insert the ‘Beitragsnummer’ that has been assigned to your roommate.

Step 3: Choose Payment Option To Pay TV License Fee

For the next step, you have to select which payment option you want. You can simply select one based on your personal preference. But these are the English translations for the payment options:

- Pay your ‘TV tax’ in Germany every 3 months (i.e. quarterly) on the 15th of the month

- Pay it every 3 months at the beginning of the months January, April, July and October

- Pay it twice a year on the 1st of January and July

- Pay it annually on 1st January

After you’ve done that, you’ll need to select whether you want to pay your TV license in Germany by direct debit or via bank transfer. This will again, depend on your personal preference. But if you’re keen to do the direct debit option. You can pay with a German bank account or an international bank account. Just make sure you have the BIC details if you’re using a non-German bank account.

Related Guide: Want to know what free banking options are available to you in Germany? Read our honest reviews for N26, Revolut and Bunq! We’ve personally tried them all.

For the last section, you’re asked to fill in your contact details in case they need to reach you. For ‘Vorwahl’, enter the telephone prefix for the city you live in Germany. If you live in Berlin like us, the ‘Vorwahl’ is 030. If you’re not sure what your telephone prefix is, check the Das Telefonbuch website. Then either enter your post code (PLZ) or city (Ort) and click on search.

Step 4: Confirm Your Information

Lastly, check that all the information you’ve submitted is correct and VOILA!

If you selected the direct debit option, the final confirmation page will say (in a whole lot of German) that you will receive a form that you need to sign and return back to the Beitragsservice. This letter just gives them permission to debit the ‘TV tax’ from your account.

So sign it, put it in the envelope that they’ve conveniently included with your ‘Rundfunkbeitrag’ letter and throw it in one of the yellow post boxes that you see around Germany.

How Do I Find My Beitragsnummer?

If it’s your first time paying ‘TV tax’ in Germany, you will only have an ‘Aktenzeichen’ and not a ‘Beitragsnummer’ (contribution number in English).

But if you’ve paid it before, you can find your Beitragsnummer on any invoice or correspondence letter you receive from the Beitragsservice. You should find it on the top right-hand corner of the first page under the date.

What Happens If You Don’t Pay TV and Radio Tax in Germany

We can’t speak from personal experience on what happens if you don’t pay your ‘TV tax’ in Germany. But we can only assume that this would be a very BAD idea since you’re legally required to pay Rundfunkbeitrag if you live in Germany.

We can only assume that they will continue to send you letters, add even more fees when you don’t pay, and maybe even send a debt collection agency after you and take legal action. Who knows?

Our recommendation? Just pay it and have the peace of mind that it won’t affect your SCHUFA (or credit score) and risk the Finanzamt coming after you too.

How To Stop Paying German TV Tax When Leaving Germany

If you ever decide to leave Germany on a permanent basis. You need to make sure that you let the Beitragsservice know so that they don’t keep asking you to pay your ‘TV tax’.

Simply doing your ‘Abmeldung’ or deregistering your address with the Bürgeramt will not suffice. So make sure you contact the Beitragsservice or go online to fill in this form to let them know you’re leaving Germany.

Related Guide: Found this step-by-step guide useful? Find out how you can convert a foreign driver’s license in Germany and get a German driving license with our comprehensive guide.

Preparing to move to Germany or just became an expat? Check out our other Moving to Germany guides for other essential expat tips as well as travel itineraries to explore Germany!